Trending Now

- IPL 2024 begins with a bang. First contest between CSK and RCB.

- Election commission allots mike symbol to Naam Thamizhar Katchi

- AIADMK promises to urge for AIIMS in Coimbatore, in its election manifesto.

- Ponmudi becomes higher education minister.

Business

RBI vs Centre: Govt refuses to back down, says central bank has to be guided by ‘public interest’

![]() October 31, 2018

October 31, 2018

Even as reports of RBI Governor considering to quit are doing the rounds following a week-long spat between the Reserve Bank and the Centre, the government today said the functioning of central bank has to be “guided by public interest and the requirements of the Indian economy”.

Although the government did not mention invoking Section 7 of the RBI Act, which empowers it to issue directions to the RBI, but the usage of words ‘public interest’ in a press release issued by Finance Ministry points that the ongoing tug of war between the two is far from over.

Under Section 7, which has never been invoked in the Indian history, the government can give directions to the RBI after consultation with the RBI Governor, considered necessary in the ‘public interest’.

The release said the autonomy for the central bank, within the framework of the RBI Act, is an essential and accepted governance requirement. “Governments in India have nurtured and respected this,” it said.

“For the purpose, extensive consultations on several issues take place between the Government and the RBI from time to time. This is equally true of all other regulators. Government of India has never made public the subject matter of those consultations. Only the final decisions taken are communicated. The Government, through these consultations, places its assessment on issues and suggests possible solutions. The Government will continue to do so,” it added.

The development comes after RBI deputy governor Viral Acharya’s fiery speech. Acharya had warned that undermining the central bank’s independence could be “potentially catastrophic”.

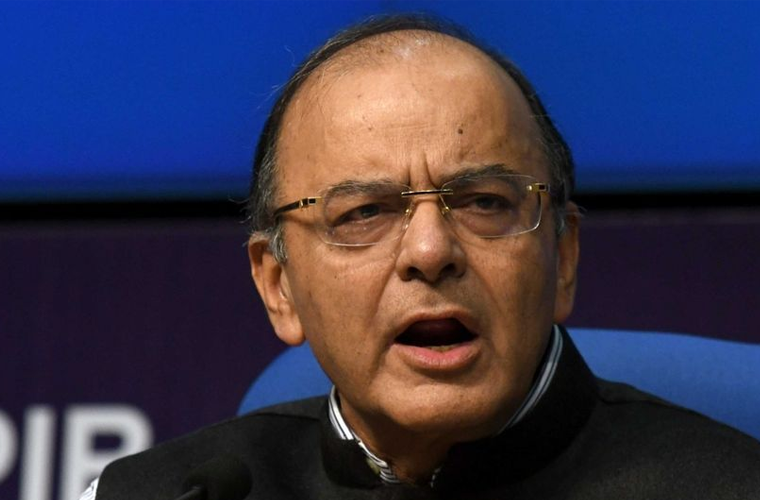

Finance Minister Arun Jaitley had criticised the Reserve Bank of India (RBI) for failing to prevent lending excess. “The central bank looked the other way when banks gave loans indiscriminately during 2008 to 2014,” Jaitley said.

The RBI and Centre have been at loggerheads over a few issues for quite some time. The government wants the RBI to help ease the liquidity squeeze gripping non-banking finance companies (NBFCs), relax the prompt corrective action regime for stressed banks, and draw further upon the central bank’s reserves to help close the fiscal gap.