Trending Now

- The film where Bobby Simha and Yogi Babu are scheduled to act together is titled ‘Nonviolence’.

- NTK leader Seeman yields a challenge. Vows to dismantle party if BJP gets more votes than his party in the constituencies that they are contesting .

- EPS condemns Kerala govt for having sent a letter to Centre seeking to construct a new dam after demolishing the Mullaiperiyar Dam.

- Schools to reopen on June 6 for students from Class 1 to XII in TN : Education Department

Real Estate

Indian buyers opting for ready-to-move homes

![]() March 12, 2016

March 12, 2016

One of the biggest challenge in current real estate market is lack of consumer confidence in the developers to deliver projects on time. This is reflected in the price differential between under-construction (UC) and ready-to-move-in (RM) properties in the secondary/resale real estate market.

The PropIndex report of Magicbricks.com which covers quarterly price movement in the secondary/resale real estate market shows that at a pan India level, RM properties command an average 5% premium over UC properties.

Consumers with purchase potential are hesitant to buy under-construction properties as project delay leads to consumer having to bear additional financial burden of paying rent over and above applicable home loan instalments. In current market scenario, consumers are opting for RM property and are willing to pay a premium as the delivery risk is low when compared to UC property and buyer can start using the property in minimum timeframe.

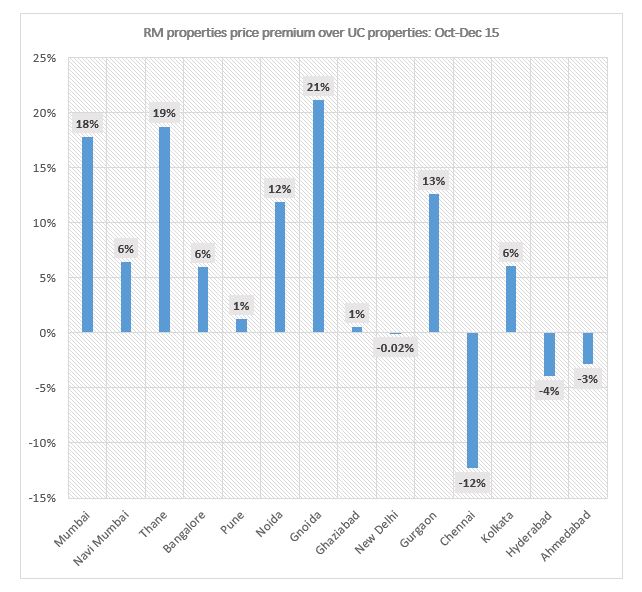

At individual city level, the premium for RM property varies from high of 21% in Greater Noida to low of -12% in Chennai; the negative premium means UC property is at a premium to RM property. The premium of RM properties over UC properties for Oct-Dec 15 quarter across 14 cities is presented below.

With exception of three cities (Chennai, Ahmedabad and Hyderabad), RM properties are at a premium to UC properties. Even in case of these cities like Hyderabad and Chennai, RM properties are at a premium in those localities with large scale development and which provide both the options.

Consumers are opting for option with less development risk in such localities. In Hyderabad, RM properties are at a premium in larger and more evolved localities which have substantial UC and RM options like Gachibowli, Madhapur, Kukatpally Housing Board and Manikonda.

In case of Chennai, RM properties are at a premium in outer suburbs and peripheral areas. This includes localities like Pallavaram, Tambaram, Pallikarnai, Perumbakkam, Padur, Kolathur, Guduvancherry and Avadi. Localities which have large construction activity and both RM and UC properties.

In case of Mumbai, overall RM versus UC debate is impacted by the fact that RM properties may be more favourably located and this impacts the premium aspect more than consumer preference for RM properties. This hold especially true to western suburban localities and those further north.

However, in localities with relatively large development activity like Virar, Vasai & Mira-Bhayandar, the RM properties are at a premium to UC properties. In case of Delhi, the trend slightly reverses itself as UC properties have seen a decline in prices with exit of investors from the market.

In other cities with large scale development activity, the distinction in prices mainly due to an aversion of a consumer to take development risk.

Price Increment

It can be surmised that in a developing market like India, UC property is likely to command a premium over RM properties. This is so because a consumer/investor can enter project at different stage of construction, it has lower entry cost and gives flexibility to book profit and exit an investment. However, these advantages are nullified in slower market like present scenario where investors have exited the market and end-users are vary of putting money in UC projects where project delivery timeline is not certain.

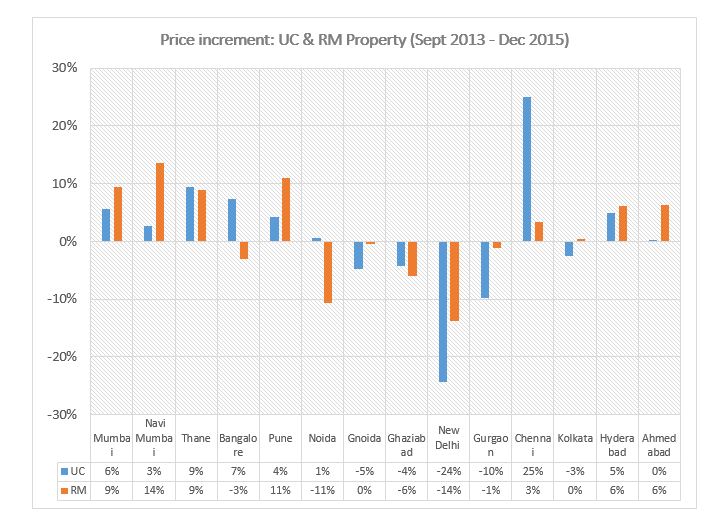

This aspect is reflected in the price increment of these two types of residential assets. The graph below gives percentage price change for UC & RM property over a 2 year period across 14 cities.

As can be seen, in 9 out of 14 cities, the relative performance of RM property segment has been better than UC property segment. Chennai remains the biggest exception as UC properties in more established localities which are contiguous with core city area preferred by consumers. In New Delhi, the decline in UC properties was more as compared to RM properties.

Conclusion

This aspect of consumer preference for RM properties needs to be considered when arguments along the lines of price cut leading to sale of unsold inventory are made. More than the price cut, a consumer is looking at the development and possession timeline of the project. And project delivery track record of the developer.

Even if a property comes at a discount but does not address these concerns, it is unlikely to get traction in the market. Simply because capital tied up in such a purchase is much more than the discount offered. And discounts are unlikely to offset the risk associated with such projects.

In conclusion, it can be safely argued that it makes perfect business sense for developers to have a good project delivery track record. And be more transparent in dealing with the consumers. Unless consumers see a sincerity on part of the developer(s) to deliver project on time, they’re unlikely to opt for such projects.

Rohit Vats