Trending Now

- 830 voters names go missing in Kavundampalayam constituency

- If BJP comes to power we shall consider bringing back electoral bonds: Nirmala Sitaraman

- Monitoring at check posts between Kerala and TN intensified as bird flu gets virulent in Kerala

Business

7 steps to take before investing in share market

![]() September 26, 2020

September 26, 2020

TCP : ADVERTORIAL

The share market investments cater to the needs and aspirations of millions of investors across India. It is because of the awareness created within the past few years and the rise of convenient online platforms that individuals are taking part in the Indian Stock

Exchanges. The two major depositories NSDL (National Securities Depository Limited) and CDSL (Central Depository Services Limited) have registered over 18 Lakh new accounts since March 2020.

The stock market is a sea of companies selling shares, bonds, securities. IPOs (Initial Public Offerings), mutual funds, etc. If one is not well-versed with the nitty-gritty of the market mechanisms, he can get immersed in this sea very easily. Thus, to make a good start towards the venture, open Demat Account with IIFL (Indian Infoline), a full-time service broker, sufficient for helping investors with the trading activities.

Let us understand what are the steps a beginner should take before investing in the share market.

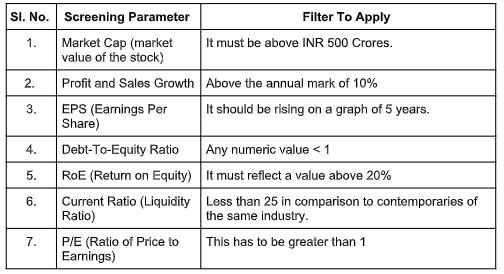

#Step 1: Learn How To Identify Potential Stocks

Before processing the entire process of trading in the market, it is important to do some initial practice on how to identify the right stocks. The fundamentals of every company and every plan look promising until one realises that he has boarded the wrong flight. Thus, it is crucial to do the homework and learn the basics of what is called “screening of stocks” before landing up opening a Demat Account. There are certain tools of parameters upon which one has to judge the nature and profitability of a stock. For a compact visual, let us consider the table below to understand.

#Step 2: Find The Best Stockbroker

Stockbrokers play a crucial role in the mechanisms of the market ever since it was commenced. During the time of offline trading, brokers were the most dominant part of this process as individuals had no direct pass in the Exchanges. With the rise of online trading, the broking service got divided into two sections – full-time brokers and discount brokers.

The former offers trading advisories and variation in brokerage plans while the latter offers only the flat brokerage service. An investor should recognize his trading needs and then choose a preferred one accordingly. Comparing the Demat Account facilities is

helpful in this case.

#Step 3: Arrange The Required Documents

Most of the individuals do not have all the required documents to trade kept handy with them. An investor needs to produce:

● Income Proof: Any document that serves as a legal document of earnings.

● Identity Proof: Aadhar card, voter ID card , etc. that holds a clear photo.

● Address Proof: Proof of permanent address of the investor.

Apart from these, a PAN (Permanent Account Number) card is a must for trading and opening the required accounts. One cannot complete the verification process without the same. In the case of NRIs (Non-Resident Indians) who wish to invest in the Indian stock market, an NRE (Non-Resident External) or NRO (Non-Resident Ordinary) account is mandatory. This account is linked with the trader’s Demat Account to complete the trading transactions.

#Step 4: Open A Demat Account And Trading Account

Demat Account and trading account are the most important ingredients of the trading process. Without either of the two, one cannot hope to participate in the online Stock Exchanges. Demat Account facilitates the dematerialization of shares and securities certificates and storing it electronically. Trading accounts are for purchasing and selling stocks in the Exchanges like NSE (National Stock Exchange), BSE (Bombay Stock Exchange), MCX (Multi Commodity Exchange), etc.

While choosing which Depository Partner would be the best, one should compare the charges and services offered against it. The low-cost management ideology helps, in this case, to make gains in the future.

#Step 5: Thrive For Transparency and Competency

Only consider the socks and securities of companies that offer transparency of management in the industry. There should be no loopholes like shady deals, misled stockholders, any kind of accounting fraud, or incidents of causing huge financial losses to the active investors. This process of analyses can be done efficiently with the help of the broker one has chosen for opening the Demat Account.

#Step 6: Read The Company’s Performance History

Reading habit is a good practice but it can also turn out to be profitable for investors if they use it the right way. One should not jump to conclusions of a company’s investment capacity without reading the financial reports, annual reports, any probable news article with the mention of its name, etc. It is important to know what kind of marketing pattern the company has been following over the years to abate risk as much as one can.

#Step 7: Quote The Price And Buy

After every possible research is done, the Demat Account and trading account are fully functioning, and one has narrowed down the potential stocks he wishes to invest in, the time is to make the purchase. One has to keep tracking the market for the time when the price of his preferred stocks is equivalent to its intrinsic value. That’s it, pay the money and complete the process using the trading account interlinked with the savings account. The purchased sock’s certificate will be reflected in the Demat Account.

Investing in the share market feels a lot easier when one has the best brokerage serviceto rely upon for smooth online trading web portals and smartphone applications. And lastly, investors should have faith in the process of share trading to reap the expected benefits.