Trending Now

- IPL 2024 begins with a bang. First contest between CSK and RCB.

- Election commission allots mike symbol to Naam Thamizhar Katchi

- AIADMK promises to urge for AIIMS in Coimbatore, in its election manifesto.

- Ponmudi becomes higher education minister.

Business

Can I invest ₹100 in mutual funds?

![]() September 12, 2019

September 12, 2019

ADVERTORIAL

Well, the answer is yes!

Although it is suggested to start with a minimum amount of ₹ 1000 or ₹500 to earn better returns, college-goers, millennials and first-time investors can invest as low as ₹100.

65% of investors are first-time investors and are also beyond the top-30 towns. Starting a SIP with ₹100 is very helpful for them to understand how mutual funds work. College students also can save as little as ₹100 because this amount is something most of them have spent in the cafeteria to buy a sandwich.

While there are countless examples to relate with, even ₹ 100 when accumulated over an appropriate amount of time, can do wonders and fulfill future monetary goals.

Whether you are a first-time investor or a college goer, if you are looking to step in the mutual fund industry, you can invest in any of the following SIP plans. Here are the five best SIP plans to invest in with just ₹100.Also, you can calculate your investment returns by using SIP Calculator.

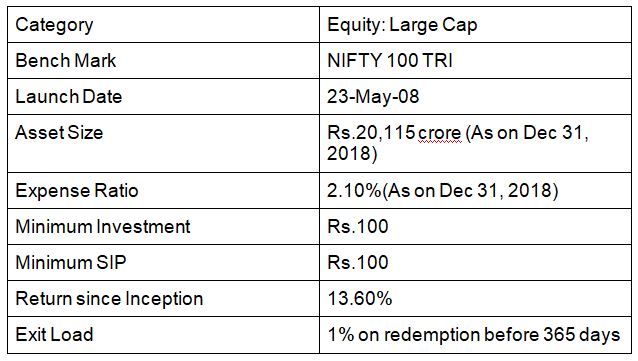

1.ICICI Prudential Bluechip Fund

ICICI Pru Bluechip Fund has been popular in the mutual fund industry. It was launch in the market crisis of 2008, and thus the beginning wasn’t quite good. But soon it provided consistent growth over time without failure and created a buzz in the industry. That’s why it is on the top of this list. ICICI Pru Bluechip Fund Growth Plan predominately invests in large-cap stocks which are well-known brands. These brands have a proven track record, quality management, and are among the business behemoths of India.

In turbulent market conditions, this scheme tends to provide growth and stability to an investor’s portfolio.

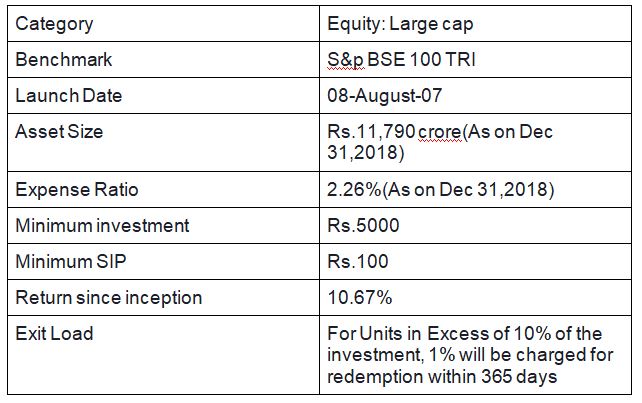

Basic information: ICICI Prudential Bluechip Fund

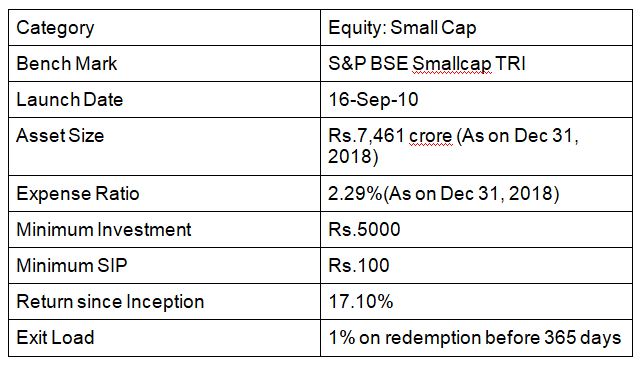

2. Reliance Small Cap Fund

Reliance Small Cap Fund launched on 16 September 2010 didn’t perform well in the beginning. However, after November 2013, there was significant growth in it and offered exceptional returns even when the small-cap index didn’t play well. This fund has performed exceptionally well in the long term and also capped losses better than its benchmark itself. Its management and strategies are excellent.

Future of funds like Reliance Small Cap Fund-Growth can be predicted through its asset allocation style. This fund invests in the equity of small-cap companies. It tends to generate consistent returns by investing in debt and money market securities. Reliance Small Cap Fund Growth is best for an investor with high-risk appetite and long investment tenure.

Basic Information- Reliance Small Cap Fund

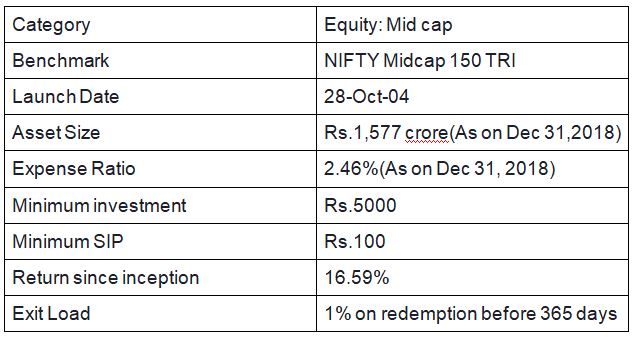

3. ICICI Prudential Midcap Fund

ICICI Pru Mutual Fund launched ICICI Prudential Midcap Fund on 24 October 2018. Its mind-blowing performance has managed to bring its name of the list of top-performing mutual funds in 2018 in the mid-cap category. ICICI Prudential Midcap Fund seeks to generate capital appreciation by actively investing in diversified mid-cap stocks. Its annual average since its launch has been around 17%.

Basic Information- ICICI Prudential Midcap Fund

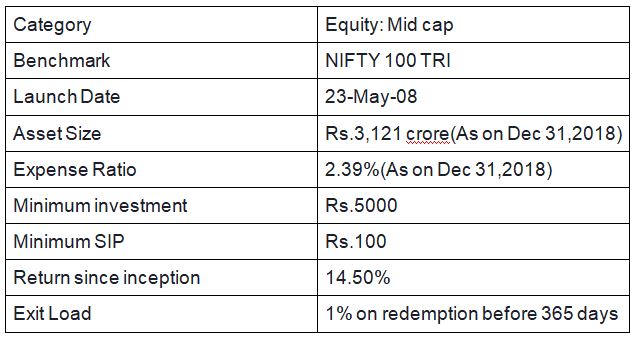

4. ICICI Prudential Multicap Fund

Another top-performer from ICICI Pru MF, ICICI Prudential Multi-Cap Fund has been a stable player of the multi-cap category. But it has managed to outperform its benchmark over a long time. The objective of these funds is to generate capital appreciation by investing in equity across large-cap, mid-cap, and small-cap stocks of various industries. At present, the fund holds 68 stocks in its portfolio where 77.9% has been assigned to the giant and large-cap companies, and the rest is distributed among mid-small-cap segments. ICICI Prudential Multi-Cap Fund is suitable for investors who are looking to invest money for 3-4 years. Also, simultaneously, the investors should be ready for the possibility of moderate losses in their investment.

Basic Information- ICICI Prudential Multicap Fund

5. Reliance Large Cap Fund

This fund has a track record of generating some of the highest returns in the category because of its sound investment strategies. Reliance Large Cap Fund is an amalgam of growth and value investing allowing it to take benefit from the opportunities arising in the equity market. It was launched to generate long term capital appreciation by investing predominantly in the equity of large-cap companies. It also aims at creating consistent returns by investing in debt, money market securities, REITs, and InvITs. It is suitable for investors who are looking to invest their money for 3-4 years and can bear probable moderate losses.

Basic Information-Reliance Large Cap Fund

I hope this article helps you to choose the best mutual funds to invest in when you are looking for investing a small amount of ₹100 every month in a disciplined manner.