Trending Now

- IPL 2024 begins with a bang. First contest between CSK and RCB.

- Election commission allots mike symbol to Naam Thamizhar Katchi

- AIADMK promises to urge for AIIMS in Coimbatore, in its election manifesto.

- Ponmudi becomes higher education minister.

Business

LIC Jeevan Pragati: Safest Plan To Invest

![]() September 20, 2019

September 20, 2019

ADVERTORIAL

All you need is an affordable plan that provides you with life cover and savings to lead a prosperous and tension free life. The LIC has brought to you the same in the form of LIC Jeevan Pragati Policy.

For Quick Referal

An endowment plan is a policy under life insurance that provides life cover as well as acts as an investment. The lump-sum assured sum is paid at the time of maturity of the policy, both in case of death and survival of the policyholder.

The benefits of the plan are eye-catching which attracts the policy buyers. The benefits of this plan are worth acceptance and beneficial for a person running a family. It brings to the family the financial security after the death of the policyholder. This can also be helpful in the higher education of your children in case of your survival or can add to your retirement plans.

Key Features

*Non-linked, savings-cum-protection with profit endowment plan.

*The plan is for an individual

*The premiums can be paid in monthly, quarterly, half-yearly and yearly installment patterns.

*The policy term is for the time period of 12 years to 20 years.

*The sum assured has a boundary limit of Rs.1.50,000 and above in the multiples of 10.000.

*The grace period is for :

30 days (Half-yearly, quarterly and yearly premiums)

15 days (Monthly premiums)

Benefits Of LIC Jeevan Pragati Plan

The benefits of the policy are unbeatable and the facilities provided by the LIC Jeevan Pragati

plan are incomparable. It convinces you very well to get one of the plans. Few of the benefit have been mentioned below which can be helpful to you in finalizing things and planning accordingly

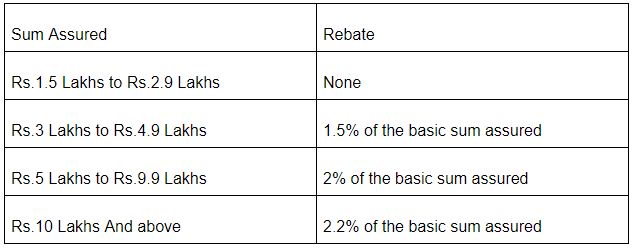

Rebate advantage: The table below shows the scale according to which the rebate is paid on high sum assured:

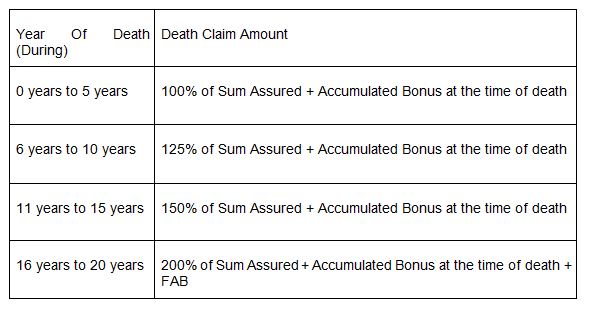

Death Benefits: In the circumstances of death within the policy tenure, the following formula is implied to calculate death benefit.

Death Sum Assured + Bonus Upto Year Of Death + Final Additional Bonus(FAB)

Moreover, the Death Sum Assured depends on the year of death and it has been explained in detail in the following table:

*Maturity Benefit: Since it is an endowment plan so, one can cherish the benefits in case of survival on the maturity of the policy under the following criterion.

Sum Assured + Bonus + FAB

*Participation In Profits: Simple reversionary bonuses announced by the Life Corporation of India are the additional benefits. The rate of interest keeps changing each year.

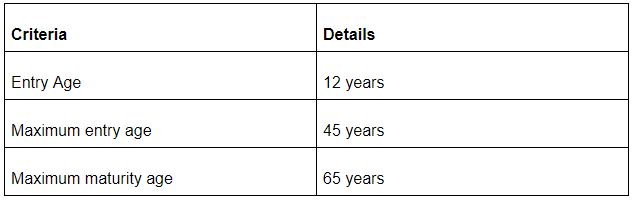

Eligibility Criteria

There are few parameters one should fit in, to buy the policy. The same is mentioned under as eligibility criteria table:

Add ons:

Few add on benefits are also the special traits of the facility that attract the policy buyers. These are mentioned below:

*Loan Facility: After completion of three years, one can avail loan facility under this plan.

*Surrender: The plan can be surrendered within the policy term but after payment of premiums for three consecutive years.

Renewal

Renewals can be done within the policy term two years from the date of the last due premium. It should be done prior to the maturity period.

Riders

The LIC Jeevan Pragati plan provides accidental death benefit rider and disability benefit rider.

Additional higher premiums are to paid for rider benefits.

Limit for accidental benefit rider

Minimum : Rs.10,000.

Maximum: Equivalent to basic sum assured. (Up to Rs.1 Crore)

NOTE: The rider sum assured should not exceed the basic sum assured according to the terms and conditions of the Life Corporation of India.

Exclusion

Suicidal cases within 12 months of buying a policy are not covered by LIC Jeevan Pragati Policy. Other than this 80% of the premiums paid excluding any taxes, any extra premium payment, and rider premium will be paid by the insurance company other than the term insurance rider subjected to that the policy is running.

Conclusion

Amidst the hustle of a metropolitan lifestyle, such a plan comes to the relief. All you need to do is get one endowment plan like LIC Jeevan Pragati Plan and lead a stress-free life. Make your family feel secure and happy with insurance backup.