Trending Now

- Action should be taken against the cops who protect the Ganja accused in TN : PMK leader Anbumani Ramdoss

- Votes that go to Congress or INDI alliance is a waste : PM Modi

- Court grants one-day custody to police to investigate Youtuber Savukku Shankar.

- We actually got our independence only in 2014. The independence to change this country as it should be : Actor , politician, Kangana Ranaut

Real Estate

How to calculate service tax on property

![]() March 24, 2016

March 24, 2016

Home buyers often want to know how much service tax they are liable to pay on ready to move property or an under-construction property. Magicbricks brings the complete calculation and experts advice to you.

Service Tax is rendered on the value of services provided by any business. In the real estate space, service tax is applicable on under-construction properties only. It is charged for building complexes, civil structures or any property that is offered for sale.

“The logic behind this is when a purchaser buys an under-construction apartment and an agreement for sale is entered between the developer and buyer, then the buyer technically becomes the owner of the property and the developer becomes the service provider for the buyer, in terms of completing the construction of the property. Thus the applicability of the service tax comes into existence”, says Rohan Agarwal, managing director, Geopreneur Group.

In the Budget 2016 session, Arun Jaitley, finance minister, proposed the Krishi Kalyan cess of 0.5 per cent, which will be implemented once the Real Estate Regulatory Bill gets executed. The proceeds of this cess will be exclusively used for financing initiatives relating to improvement of agriculture and welfare of farmers. This will contribute towards better agricultural production and economy.

Service tax is presently 14.5 per cent of the agreement value but there is a rebate for real estate to the tune of 70 per cent (against input cost of land & materials purchased). Thus the applicable Service tax is 14.5 per cent of 30 per cent which equals to 4.35 per cent. You can calculate the service tax for your property according to your budget segment.

Calculate service tax on under-construction properties

Properties worth less than Rs 1 crore of value: 25% service tax is applied on the base price

Properties worth more than Rs 1 crore of value: 30% service tax is applied on the base price

Exemptions

Service Tax is applicable on all residential and commercial properties irrespective of their usage. The only exemptions are:

On sale of single owner stand-alone residential dwelling

Ready-to-move-in property with Occupation Certificate

The Budget 2016 session has exempted developers from paying service tax for the construction of houses less than 650 sq ft.

Answering buyer queries

Magicbricks asked Vaibhav Sankla, director, H&R Block, to answer some consumer queries related to the implications of service tax.

From our Forum

Raja Mohan: Is it necessary that possession of under-construction flats should be within 3 Financial Years of the date of sanction of home loan to avail IT exemptions? If true, then what is the way out if possession is not completed within the specified time?

Vaibhav Sankla: The rule states that if construction is not completed within 3 years from the end of the year in which you have availed home loan then the annual interest deduction is capped at Rs 30,000 (instead of Rs 200,000). However, please note that this rule is applicable only to a self-occupied house. If you let-out the house after obtaining possession then you would be eligible to claim deduction of the entire amount of interest (including deduction on pre-construction period interest).

Prashant Deshpande: What are the taxes involved in the sale and purchase of a residential flat? I want to sell my old flat and purchase a bigger resale flat in Pune.

Vaibhav Sankla: If you are selling your old flat then you will have to pay TDS at 1 per cent if the sale price exceeds Rs 50 lakh. This TDS can be claimed while filing your income tax return the next year. The long term capital gains arising on the sale shall be exempt from income tax if you reinvest the amount of gain in another house within 2 years from the date of sale of the old house.

You should deduct income tax at 1 per cent of the purchase value (assuming it exceeds Rs 50 lakh) and pay only the balance to the seller of the new house. The tax so deducted should be deposited with the income tax department within 7 days of the following month. The newly acquired house should not be sold before 3 years from the date of its purchase.

Service tax on ready-to-move-in property

Ready-to-move-in properties do not attract any service tax as the developer is selling a completed property and not rendering any services to the buyer.

“Property transactions have significant tax implications and provide a lot of opportunities in tax savings. Hence, it is recommended that you obtain professional tax advice before entering any property transactions,” suggests Sankla.

Time limit for a developer to pay service tax

Service tax can be paid either on a monthly basis or on a quarterly basis, depending upon the developer’s previous years’ Service Tax returns. “Service tax should be paid to the Central Government, by the 6th day of the month, immediately following the calendar month in which the service is deemed to be provided as per the rules framed in this regard,” says Aman Agarwal, director, KV Developers.

However, service tax on the service deemed to be provided in the month of March shall be paid to the the Central Government by 31st March of the calendar year.

Consumers like to buy properties with low rates. If one chooses to buy an under-construction property, the loan and the interest rate piles on with the service tax. In case of ready-to-move-in properties, there is no liability of the service tax. Remember this before you invest.

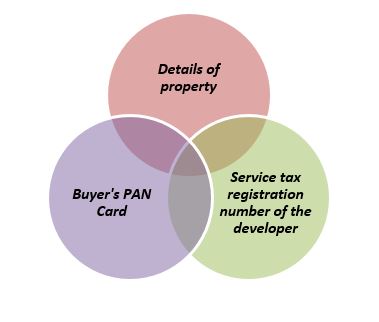

Documents required to pay service tax…

Sukriti Yaduwanshi