Trending Now

- Action should be taken against the cops who protect the Ganja accused in TN : PMK leader Anbumani Ramdoss

- Votes that go to Congress or INDI alliance is a waste : PM Modi

- Court grants one-day custody to police to investigate Youtuber Savukku Shankar.

- We actually got our independence only in 2014. The independence to change this country as it should be : Actor , politician, Kangana Ranaut

Real Estate

The Chinese real estate agent boom

![]() June 16, 2016

June 16, 2016

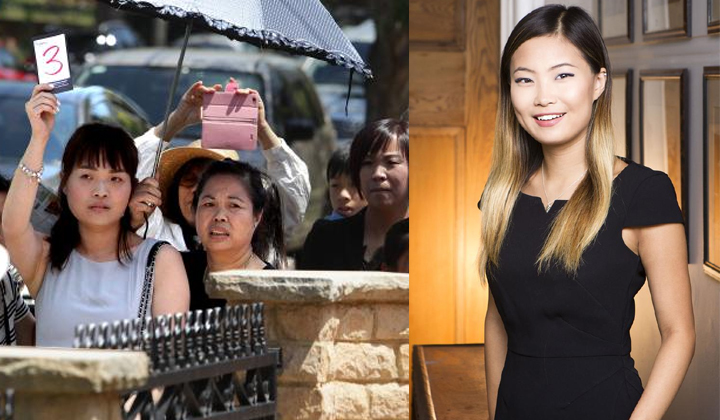

ADETTE Cao is the face of the next Chinese real estate boom.

The 20-year-old UNSW student is still in her final year of PR and advertising, but she has already switched careers.

As a sales associate at real estate agency Richardson & Wrench, she is on track to become a full agent at least five years earlier than normal.

No longer content to buy Australian real estate, native Chinese are becoming some of the country’s top real estate agents.

Ms Cao, who was born in China and emigrated to Australia at the age of seven, is fluent in Mandarin — an increasingly valuable skill.

“My parents have always invested in property and my mum works in real estate, so it’s always been in the background,” she said.

“I got into my second year of uni and realised PR wasn’t what I wanted to do. I like the interaction with people in real estate, and it’s always different day-to-day with new properties coming on the market.”

James Pratt, director of auctions at Raine & Horne and J Pratt Realty, said native speakers of Mandarin and Cantonese now make up at least one-third of the would-be real estate agents studying at the TAFE NSW in the city, where he teaches sales and auctioneering.

Five years ago, he said, there were only a handful of native Chinese students in the typical class.

In the two classes this month, 30-40 per cent are of Chinese descent. Seventy per cent of these students were born in China, with English their second language.

Mr Pratt said they tend to be more focused on real estate as a profession than many other students, so they work hard to do well in the course.

“I wouldn’t be surprised if, in 10 years, a majority of the most productive 100 real estate agents in NSW are native speakers of Chinese,” he said.

One of Mr Pratt’s former students, Dani Zhao, now represents about 100 ultra high-net-worth Chinese individuals on large-scale commercial and residential investments, and is currently representing a buyer on a $20 million transaction.

Ms Zhao, whose background was in managing large events such as Chinese New Year celebrations, said doing business with Chinese investors was all about trust.

“There are so many investors trying to find a good deal, but they want to find somebody trustworthy to work with,” she said.

Ms Cao, whose goal is to open her own agency at some point, believes Chinese appetite for Australian property will continue, despite recent changes such as higher stamp duty costs and increased capital controls out of China, which some experts have described as “horrifying”.

“The Chinese market is too expensive for a lot of people to afford,” she said. “It’s a lot cheaper for them to buy something here, although some of the legislation they’re putting in place might deter them in future. It’s really hard to gauge.”

She said Chinese people still perceive western countries as superior. “The environment is better, and ideally they probably want to move here,” she said.

Ms Zhao agreed, saying for large investors the changes wouldn’t be a problem. “It might affect small residential overseas buyers, but I think for the big developers they don’t mind,” she said.

According to Ray Dimarco, head of studies at TAFE Property in Sydney, there have been major changes over the last 10 years.

“Student composition used to be 10 per cent Chinese and is now over 30 per cent Chinese,” he. “I believe the increase is based at least in part on the high demand for buyers agents to act for only clients in China, but also for local buyers in Sydney.”

Gavin Norris, Australia head for Chinese international property portal Juwai.com, said mainland Chinese had gone from 10 per cent to 25 per cent of the foreign buyer market in the past five years.

“You do not have to be Chinese to succeed with Chinese buyers,” he said. “A good agent is a good agent, no matter where they were born or what language they learned first.”

Mr Norris said property had a greater cultural role as a symbol of wealth and success, and as a vehicle for investment and savings, in China than it does in Australia.

“The increase of buyers from mainland China and from other countries with large Chinese-ethnicity populations has made real estate agency principals more willing to give these agents, who sometimes speak English imperfectly, a fair go,” he said.

Last year, the Foreign Investment Review Board approved $24.3 billion of Chinese real estate investment, with the top cities being Melbourne, Sydney, Brisbane, Adelaide and the Gold Coast.

According to Juwai.com, Chinese buyers made 61 per cent more inquiries on Australian property in the first quarter of 2016 than the same period last year.