Trending Now

- 830 voters names go missing in Kavundampalayam constituency

- If BJP comes to power we shall consider bringing back electoral bonds: Nirmala Sitaraman

- Monitoring at check posts between Kerala and TN intensified as bird flu gets virulent in Kerala

Coimbatore

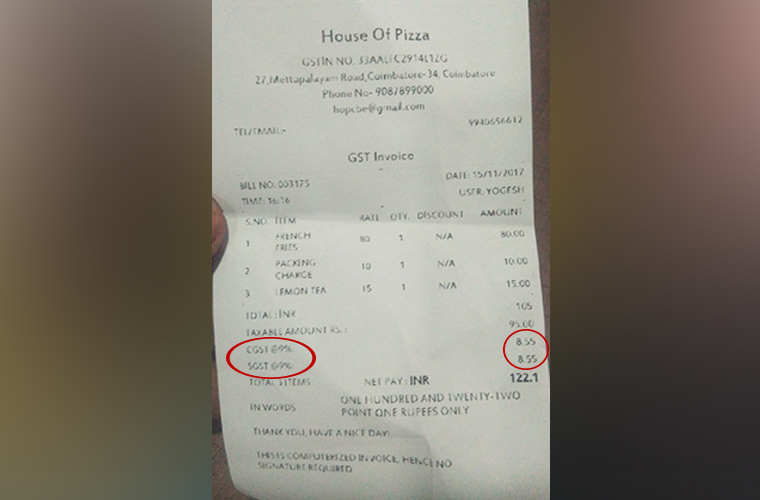

Some Covai restaurants continue to levy 18% GST on consumers

![]() November 15, 2017

November 15, 2017

The revised GST slab for several items and some services came into effect on Wednesday. Among the services are the restaurants for which the Goods and Services Tax was fixed at a uniform 5 per cent. Yet, some of them in Coimbatore charged the customers with old GST rate.

As per the recommendations made by the GST council on November 10, all stand-alone restaurants irrespective of air conditioned or otherwise, will attract 5 per cent without Input Tax Credit (ITC). Food parcels (or takeaways) will also attract 5 per cent GST without ITC. Restaurants in hotel premises having room tariff of less than Rs.7500 per unit per day will attract GST of 5 per cent with full ITC. Only the restaurants in hotel premises having room tariff of Rs.7500 and above will charge GST of 18 per cent with full ITC.

Previously, the tax levied by A/C restaurants was 18 per cent, non-A/C restaurants was 12 per cent and eateries with an annual income of 20-75 lakh was 5 per cent. But all these categories were brought under a uniform 5 per cent GST since Wednesday.

While the restaurant owners were happy and were vocal about the tax reduction, which they said, would bring the customers back to eating out, not all followed it in spirit on day one of revised slab. One such errant restaurant was the House of Pizza on Mettupalayam Road which charged 18 per cent GST from its customers.

When the issue was taken to the knowledge of a top official with the Department of Central Excise, he assured to take action and said the customers should have the awareness and question the restaurant owner if the old tax is levied. He also said some of the restaurants, including the famous ones, do not bill the takeaways and food items consumed there, which otherwise means the amount towards purchase would not come under the purview of the central excise department.

“Until the customers insist for bill, this unethical trade practice cannot be controlled,”he said.