Trending Now

- Alliance talks between AIADMK and BJP are ongoing. An announcement will be made at the right time – Union Home Minister Amit Shah.

- Vijay spoke about TVK vs. AIADMK only to motivate party workers – AIADMK General Secretary Edappadi K. Palaniswami.

- South Indian audiences are not interested in Hindi films, which is why they don’t succeed – Salman Khan.

- KL Rahul joins Delhi Capitals; the team will face Hyderabad tomorrow.

Columns

The EPF tax is not going to fetch much revenues, does it need this controversy?

![]() March 5, 2016

March 5, 2016

Mumbai: #RollbackEPF has been trending on social media ever since the government proposed in the budget to levy a tax on Employees’ Provident Fund (EPF) withdrawals. The decision has already generated a lot of middle-class angst and debate and has led to much confusion since the government is yet to clarify on what exactly is to be taxed and how much. However, all this commotion might be a little unnecessary for the government, at least from one point of view—this tax is likely to fetch little revenue to the government and that too many years later.

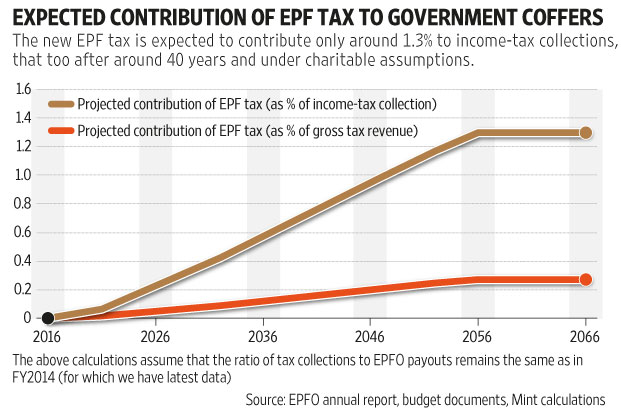

Mint Money calculations have already shown that the effective tax rate for an individual would be 12% of the corpus at the time of provident fund withdrawal, assuming that 60% of interest earned is taxed at the maximum rate of 30.9%. Assuming that the average work-life of an employee is 40 years, the full effect of the new EPF tax proposals is likely to be manifest only after 40 years, given that interest accrued on contributions made only after 1 April 2016 are going to be taxed. Using other assumptions, (details below) the proceeds from the EPF tax are likely to amount to only around 0.3% of the total gross tax collections or 1.3% of the gross income-tax collections, that too after 40 years.

This too is liable to be an overestimate, as we assume that interest accrued on 60% of total contributions will be taxed, rather than only on the employees’ contributions. If instead only employers’ contributions are to be taxed and employees’ remain tax-exempt, then the effective tax rate on withdrawal gets halved from 12% to 6%. Consequently, the likely proceeds from EPF tax will amount to 0.15% of the gross tax collections rather than 0.3%.

If we adopt slightly more generous assumptions—that the government will tax 60% of the entire corpus at withdrawal rather than just the interest component, even then the likely tax collections will eventually amount to 0.5% of the gross tax revenue rather than 0.3%, in the scenario when tax is levied only on the interest component.

Thus, even under generous assumptions, it seems that the current controversy over EPF taxation is essentially over a very small potential increase in tax revenues.

However, to be fair, the government has clarified that the intent of the recent tax proposal is to bring parity between the National Pension System (NPS) and EPF, as previously reported by Mint . In case of NPS, the government has sought to make 40% of the corpus, which can be withdrawn at retirement, tax-free. The rest 60% of the NPS corpus is taxable. However, if the amount is put in an annuity or pension product, it will escape immediate taxation, as the annuity proceeds will by fully taxable. Thus, the current proposal to tax EPF will bring some sort of parity with the taxation on 60% of the NPS corpus.

How did we calculate expected tax revenue from the EPF tax proposal?

For estimating how much the EPF tax would contribute to the government’s tax kitty, we have assumed that gross tax collected (out of existing sources) and the amount that the Employees’ Provident Fund Organization (EPFO) pays to the public every year will grow at similar rates in the coming years. This assumption can be justified on the grounds that overall tax collections and EPFO’s reach are both related to economic growth in the country. Hence, we assume a constant ratio between the two—gross tax revenue out of existing sources and EPFO disbursals. We also assume that individuals withdrawing EPF do not invest back in annuity, as that would make the EPF withdrawal tax-exempt. Thus, this is a generous assumption from the perspective of tax revenue collection. Then we assume, for simplicity, that in a year, all disbursals are to be made to those who worked and contributed to EPF for 40 years, assuming there were no premature withdrawals. Lastly, we assume that 75% of tax contributions are to be from those in the highest tax bracket. Even if we relax the assumption and assume that all the withdrawals will be made by individuals in the top tax bracket, the projected tax collections will eventually amount to only 0.35% of the gross tax revenue, rather than our base case of 0.3%.

Tadit Kundu

Disclaimer:The views expressed above are the author’s own