Trending Now

- 830 voters names go missing in Kavundampalayam constituency

- If BJP comes to power we shall consider bringing back electoral bonds: Nirmala Sitaraman

- Monitoring at check posts between Kerala and TN intensified as bird flu gets virulent in Kerala

Whats Hot

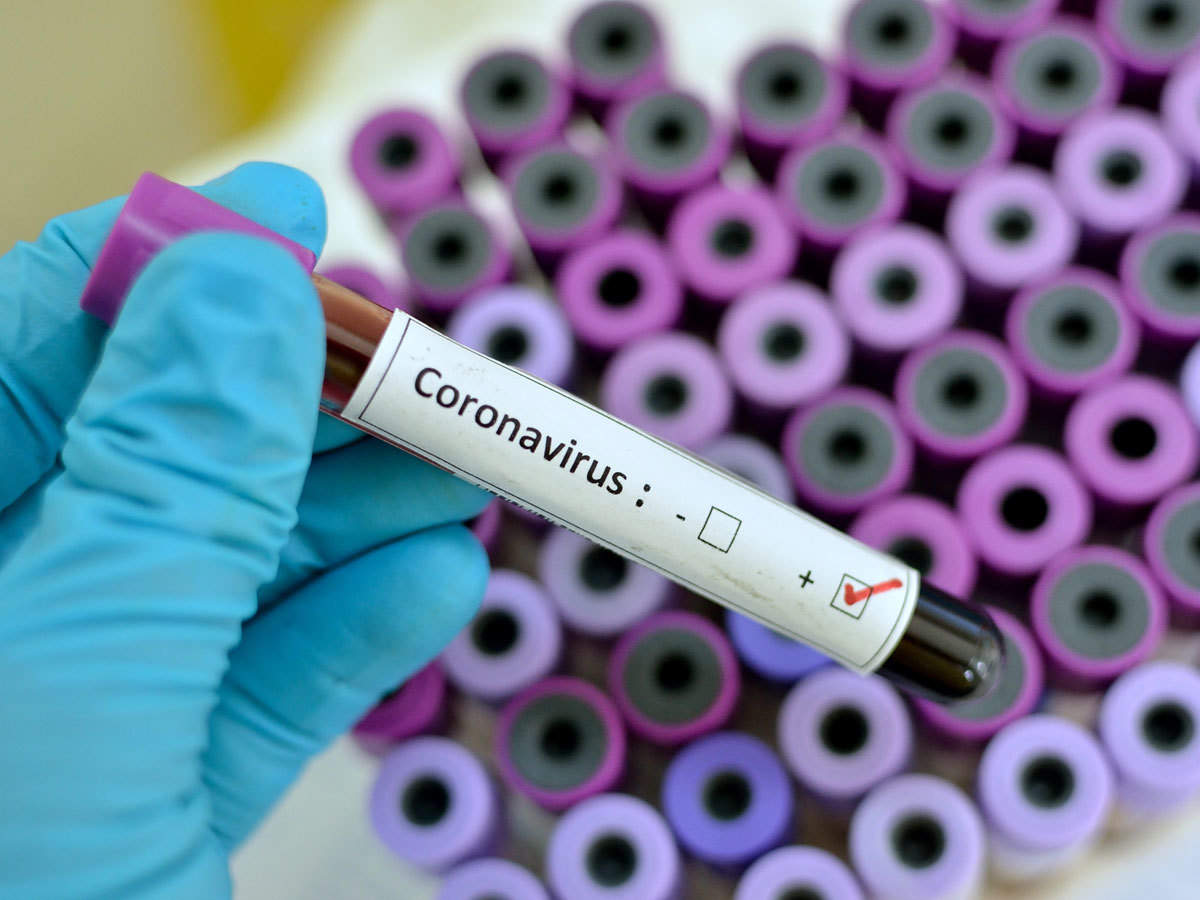

FM Sitharaman announces 8 major relief measures to boost Covid-affected sectors

![]() June 28, 2021

June 28, 2021

Finance Minister Nirmala Sitharaman on Monday announced a credit guarantee scheme worth Rs 1.1 lakh crore for Covid-affected sectors. Addressing a press conference in New Delhi, she also said that Rs 50,000 crore has been allocated for scaling up the health sector.

“We are announcing about eight economic relief measures, of which four are absolutely new and one is specific to health infrastructure. For Covid-affected areas, Rs 1.1 lakh crore credit guarantee scheme and Rs 50,000 crores for the health sector,” said Nirmala Sitharaman.

Interest rate – new credit guarantee scheme

The Finance Minister announced a new credit guarantee scheme. As many as 25 lakh people stand to benefit from the scheme, she added.

“Loans will be given to the smallest borrowers by micro-finance institutions. A maximum of Rs 1.25 lakh amount to be lent. The focus is on new lending and not on repayment of old loans,” Sitharaman told reporters on Monday.

Union Finance Minister Nirmala Sitharaman said the interest rate under the new credit guarantee scheme is two per cent below the RBI prescribed rate, with a loan duration of three years. The focus will be on new loans and stressed borrowers, with the exception of NPAs (non-performing assets), will be covered under this scheme.

She went on to add that the new credit guarantee scheme will also reach out to the “smallest of the small borrowers” in the hinterland, including in small towns.

Big boost for travel industry

As part of the announcements on Monday, Sitharmanan also announced relief for the tourism sector. Travel agencies, she said, will be able to get a retail loan of Rs 10 lakh while tour guides will be eligible for a loan of Rs 1 lakh.

The first five lakh tourists will be provided with visas free of cost, she added.

Emergency credit line guarantee scheme

Finance Minister Nirmala Sitharmana said that the overall cap of the Emergency Credit Line Guarantee Scheme (ECLGS) scheme will be raised to Rs 4.5 lakh crore from the earlier Rs 3 lakh crore.

The ECLGS was launched as part of the Aatmanirbhar Bharat package last year to facilitate collateral-free loans to MSMEs.

Rs 50,000 crore for health sector

An amount of Rs 50,000 crore has been earmarked for scaling up medical infrastructure in the country, said Sitharaman.

An additional Rs 23,220 crore has been allocated for public health, with a sharp focus on children and paediatric care.

Broadband in each village

The central government has decided to allocate an additional Rs 19,041 crore to be spent on providing broadband in each village across the country.

Power distribution scheme

Rs 3.03 lakh crore has been earmarked for a ‘reform-based result-linked’ power distribution scheme. This amount will assist DISCOMS (state-owned power distribution companies) in creating more infrastructure and upgrading existing systems.

The Centre’s share in this would be Rs 97,631 crore.

Production-linked incentive scheme extended

Nirmala Sitharaman also announced a production-linked incentive scheme to incentivize large-scale electronics manufacturing for another year. Investments made in 2020-21 will continue to be covered under this scheme.

“Companies can opt to choose any five years for meeting production targets,” she added.

Boost for project exports

During the press conference on Monday, Sitharaman also proposed an additional corpus to the National Export Insurance Account (NEIA). This would allow the NEIA to underwrite an additional Rs 33,000 crore of project exports over five years.

The NEIA Trust promotes medium and long-term project exports by extending risk cover.